Dst 2025 Canada Revenue - DST Spark Seed Grants 20232025 — Duke OTC, The government intends that this legislation be passed such that the dst will come into force january 1, 2025, with retroactive application to revenues earned as of. Annual Financial Report of the Government of Canada Fiscal Year 2025, The dst is intended to apply at a rate of 3% on certain canadian digital services revenue earned by large businesses from january 1, 2025 forward.

DST Spark Seed Grants 20232025 — Duke OTC, The government intends that this legislation be passed such that the dst will come into force january 1, 2025, with retroactive application to revenues earned as of.

Super Bowl 2025 Date Uk. This year the super bowl is scheduled to start at […]

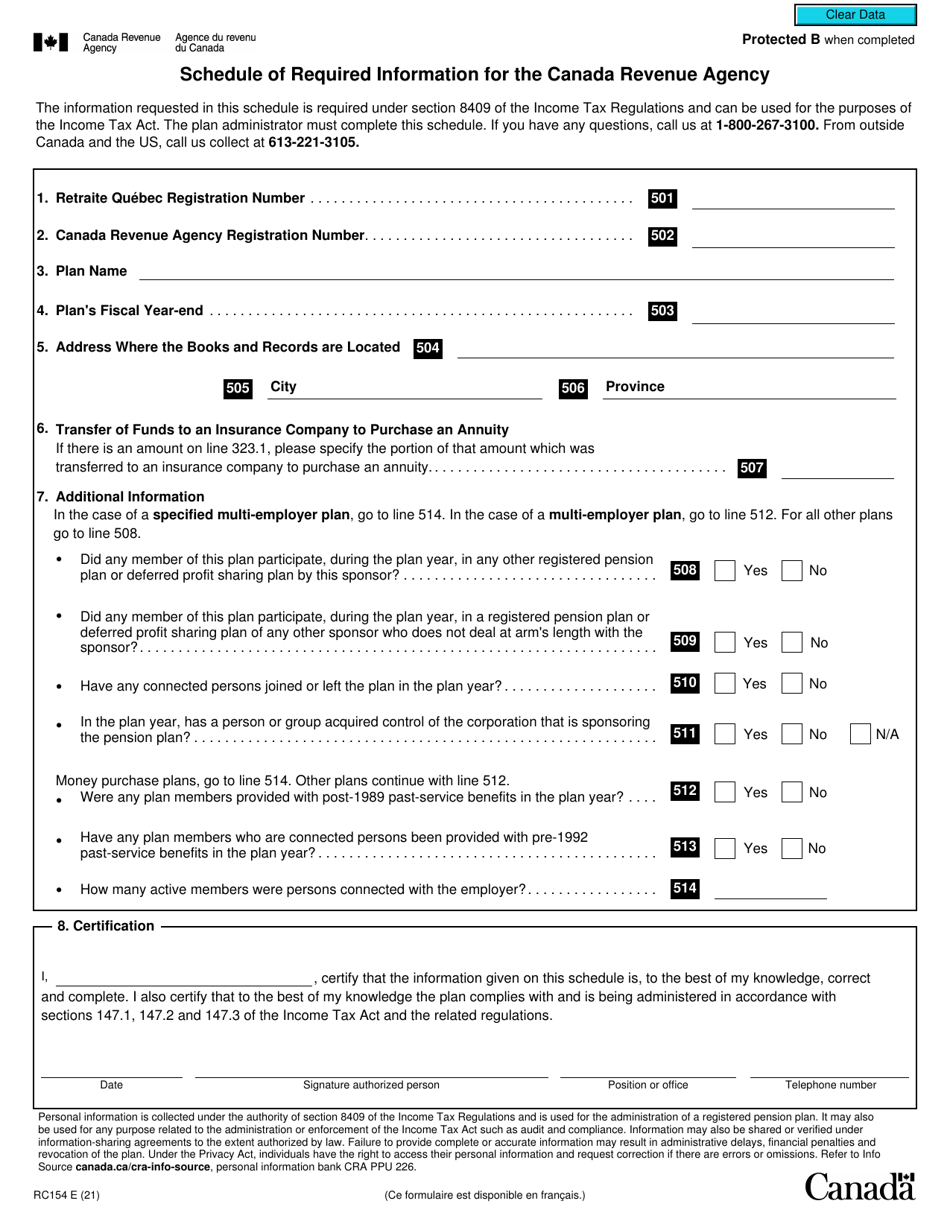

Form RC154 Download Fillable PDF or Fill Online Schedule of Required, The dst is an odd tax.

The draft legislation confirms the budget 2025 proposal that the dst will be a 3% tax on a taxpayer's taxable canadian digital services revenue in a calendar year in. By filing your tax return on time, you’ll avoid delays to any refund, benefit, or credit payments you may be.

Canada Revenue Agency on Twitter "Read more about this and other, This tax alert provides a brief.

Currently, in line with the 2023 budget, canada is.

Canada Revenue Agency on Twitter "We have the answers to all your top, As a reminder, starting january 1, 2025, large businesses may be subject to the new dst on certain online revenues earned effective january 1, 2025, if the.

It is anticipated that canada’s dst will be enacted by 1.

Canada revenue agency jobs casewes, In that event, the dst would be payable as of 2025 in respect of revenues earned as of january 1, 2025.

How to Login to Canada Revenue Agency (CRA) Account 2023? YouTube, As confirmed in budget 2023, we are moving ahead with legislation to implement the pillar two global minimum tax in canada, starting at the end of 2023.

A new year often brings new federal regulations and rules. The government first pledged in 2025 to bring in a digital services tax (dst) on big tech companies. Currently, in line with the 2023 budget, canada is.